The Holborn Group has been trying to develop this downtown site for eight years, and the city hasn't supported earlier proposals. Now, Holborn is proposing to build what would become Metro Vancouver's tallest skyscraper.

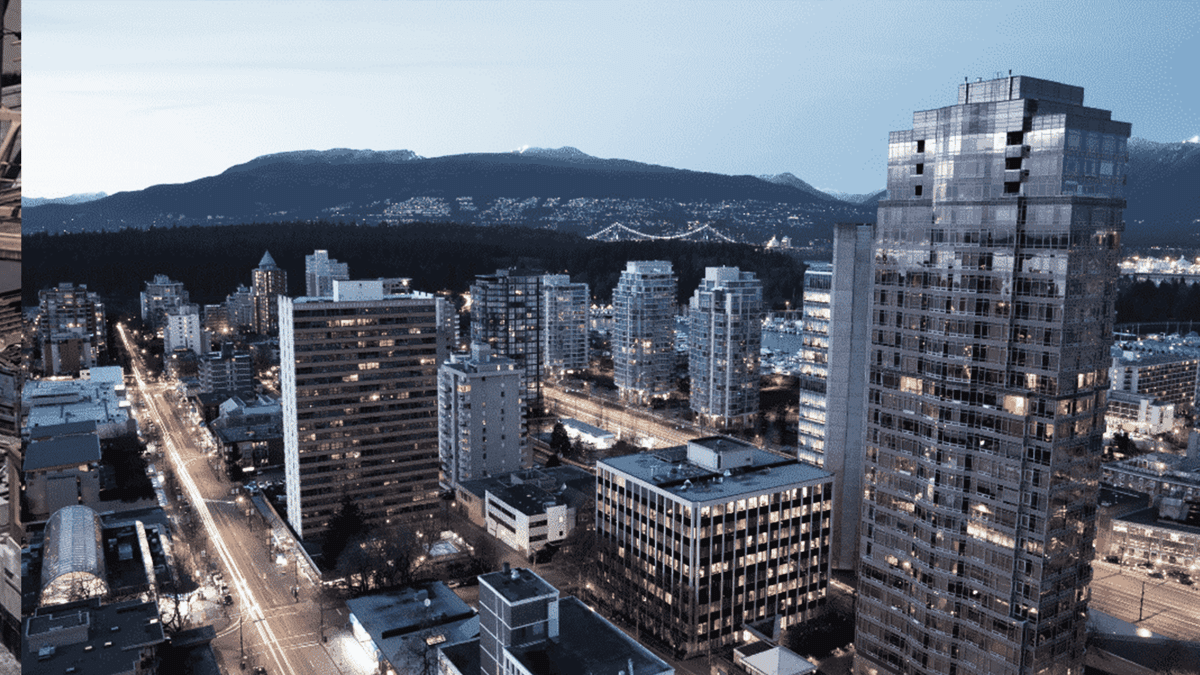

A Vancouver developer wants to transform the downtown skyline with a massive development encompassing nearly two entire downtown blocks. It would include a trio of skyscrapers, the largest of which would reach more than 300 metres — the tallest in the city.

The project would be almost 50 per cent taller than the current tallest in Metro Vancouver, which is Two Gilmore Place in Burnaby at 218 m (64 storeys).

The project has been nearly two decades in the making. Now is the right time to move forward, says the president of developer Holborn Group, as Vancouver is growing bigger with “ambitions to be more like a world-class city.”

Holborn has applied to build a project, designed by Henriquez Partners Architects, which involves a total of four towers at two different downtown locations.

An illustration showing a development proposed for downtown Vancouver from the Holborn Group and designed by Henriquez Partners Architects. Sectional view from Seymour Street looking east. Credit: Holborn Group / Henriquez Partners Architects Photo by Norm Li

On the larger of the two sites, Holborn proposes to build three towers between 68 and 80 storeys, including condos, market rental homes, commercial space and a 920-room hotel on the parcel between the 500-block of West Georgia and Dunsmuir streets. This parcel includes the now-vacant site at 500 Dunsmuir St., where a heritage building Holborn bought in 2006 was emptied in 2013 and then ordered demolished earlier this year after the city declared it was at risk of imminent collapse. The parcel also includes The Bay parkade, and the Randall building at 555 West Georgia St., which for years featured a beloved six-storey mural.

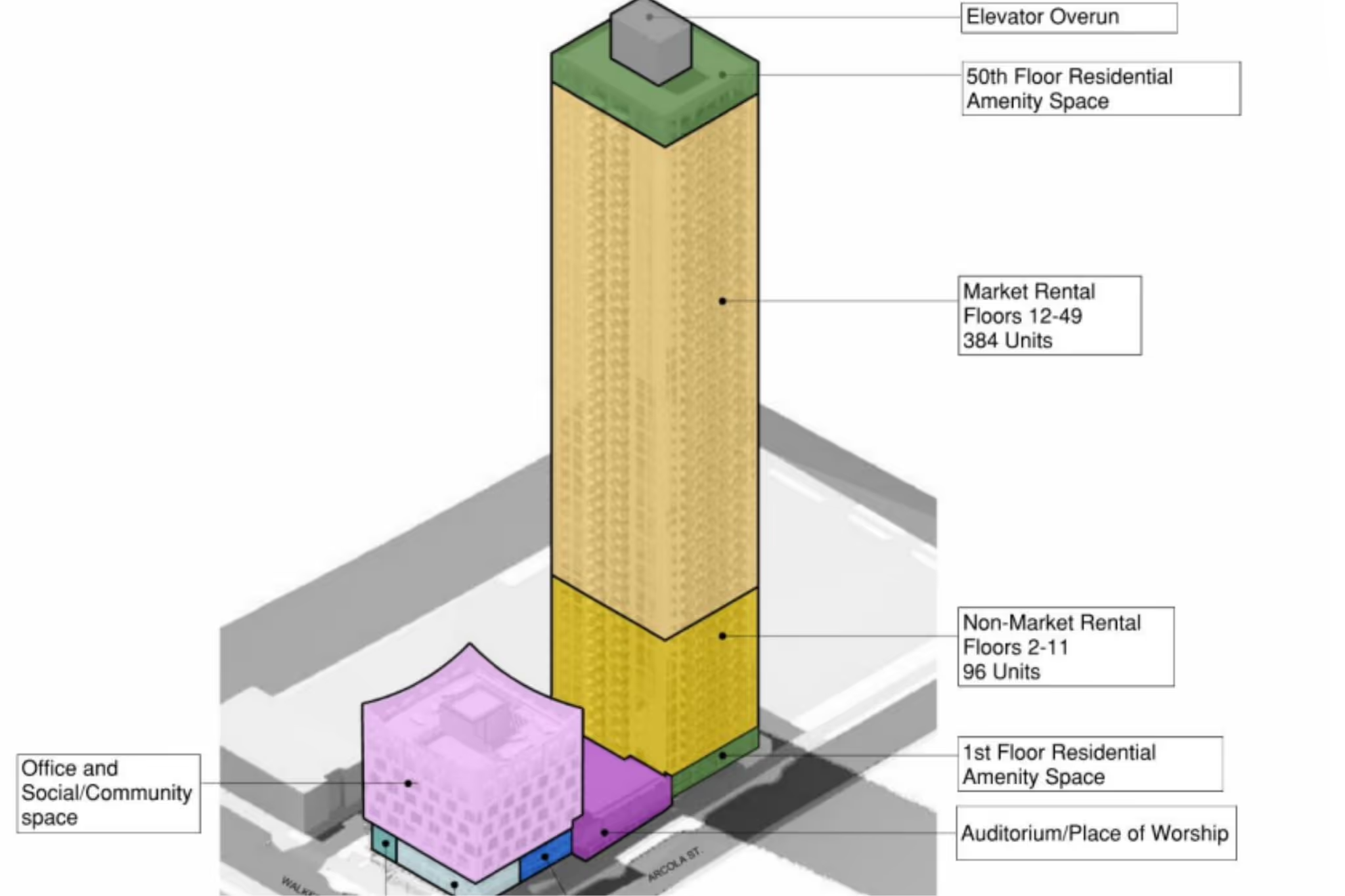

The proposal also includes developing a second site owned by Holborn, a Downtown Eastside parking lot, where the company is pitching a 38-storey tower with social housing, child care and an Indigenous art gallery. The entire building would be turned over to the city upon completion.

Demolition of a heritage building at 500 Dunsmuir Street on Jan. 20. Photo by NICK PROCAYLO /10106970A

Holborn acquired The Bay parkade and 500 Dunsmuir St. in 2006, and then over the next 18 years acquired most of the other properties on that two-block parcel, with the exception of 570 Dunsmuir St., an eight-storey commercial building that houses private educational institutions and has a different owner. The final piece for Holborn was the acquisition of the Randall building, a 1929-built commercial structure at 555 West Georgia St., last year.

For at least eight years Holborn has been in touch with city hall about developing the downtown site. City hall didn’t support a series of earlier proposals designed by different architects and submitted on behalf of Holborn between 2017 and 2023.

An illustration showing a development proposed for downtown Vancouver from the Holborn Group and designed by Henriquez Partners Architects. View of observation deck looking west. Credit: Holborn Group / Henriquez Partners Architects Photo by Norm Li

“We were told, ‘No, no,’ so many times, so we know what not to do this time,” Holborn president Joo Kim Tiah said with a laugh this week. “I want to say it in a very respectful way. But I think the idea was probably too big at first, because, Vancouver was, maybe, not really used to such an ambitious project.”

But after “having persevered so many years,” Tiah said, he believes city planning staff now see “the city growing bigger and has ambitions to be more like a world-class city.”

The project aligns with priorities of the current city council and planning staff, such as boosting the supply of hotel rooms and homes downtown, Tiah said.

“So as all these things became more and more pressing, now I guess they are now more open to the fact that, ‘Hey, actually a big project like this does bring a lot of benefits’ … I think more and more, over time, they warmed up to the idea.”

An illustration showing a development proposed for downtown Vancouver from the Holborn Group and designed by Henriquez Partners Architects. View of the plaza at Seymour and West Georgia streets. Credit: Holborn Group / Henriquez Partners Architects Photo by Norm Li

Conversations with city hall about the earlier proposals only ever reached the pre-application inquiry stage. About 18 months ago, Henriquez Partners Architects started working on the newest iteration, and last week, the partnership submitted the first formal rezoning application for the project.

Said Gregory Henriquez, the company’s managing principal: “We learned a lot from what the other architects did and tried to incorporate all the lessons learned and comments given, over the years, into this design.”

Henriquez said the design is inspired by ancient glass sea sponge reefs found off the B.C. coast, and they believe the project will be a “landmark in the heart of Vancouver.”

The project has evolved over time.

Earlier versions of the project included office space, but the new design has removed that component, responding to the dwindling demand.

Another major change in the project’s evolution was city council’s decision last year to revise rules protecting public views, which enabled this site to go higher.

Henriquez Partners’ earlier version of the project, designed last year, planned to incorporate the heritage building at 500 Dunsmuir St., Henriquez said.After Vancouver’s chief building official recommended the derelict building’s demolition last December, saying it had become a “danger to public safety,” it was demolished in January. That unexpected development prompted a redesign of the whole project, Henriquez said, changing it from two thicker towers to three thinner ones.

An illustration showing a development proposed for downtown Vancouver from the Holborn Group and designed by Henriquez Partners Architects. View of 388 Abbott St. Credit: Holborn Group / Henriquez Partners Architects Photo by Norm Li

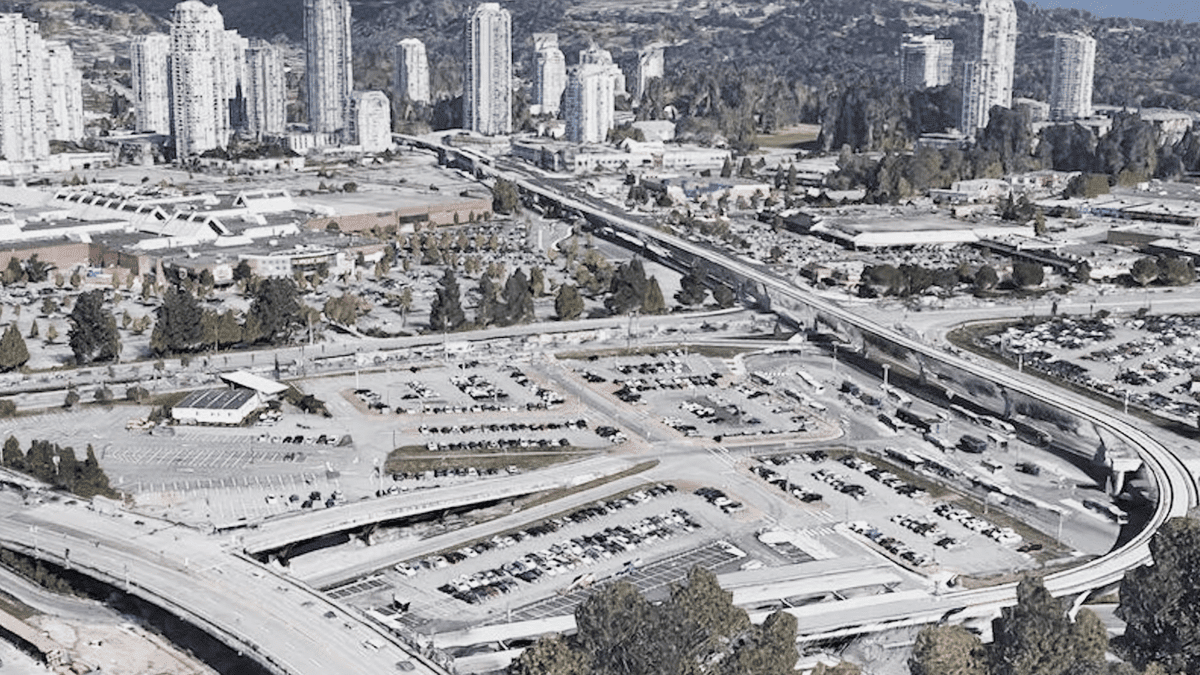

The Abbott Street site that forms the other part of this proposal has been owned by Holborn since 2004. In 2018, Holborn applied to build a 10-storey market rental building on that site, which was approved by the city.

Asked why that rental housing project never moved forward, Tiah said that the company decided it made sense to tie the development of both the Georgia and Abbott properties together, “revitalizing two areas of town.”

The project would include a total of 1,939 new homes, a 920-room hotel, 64,000 square feet of retail space and a public plaza on West Georgia Street.The Abbott site would include 378 non-market homes, in a 38-storey building, roughly the same size as the Woodward’s tower across the street, which was also designed by Henriquez and completed in 2010.

Holborn is a local development company owned by one of Malaysia’s wealthiest families. The developer is known for building Vancouver’s Trump Tower on West Georgia, which has since been renamed, and the Little Mountain project, which was criticized because of delays in delivering the social housing units that were promised to replace those demolished on the site.

By Dan Fumano Published May 08, 2025

Source: Vancouversun.com

link: https://vancouversun.com/news/massive-development-proposed-for-downtown-vancouver?utm_campaign