Mayor Ken Sim is calling on City of Vancouver staff to explore new planning approaches for five strategically located industrial areas that could play a pivotal role in delivering both jobs and housing — particularly near existing and future SkyTrain stations.

In a member motion expected to be approved by Vancouver City Council next week, Sim is calling on City staff to process without delay existing and new rezoning applications at what he describes as five “exceptional sites” across the city.

Furthermore, City staff will perform a deep dive on the technical and policy implications of the redevelopment potential of each site.

One of the biggest hurdles is the designation of these sites as protected industrial lands by Metro Vancouver Regional District. The regional district is generally very cautious with removing industrial land designations, as the region is experiencing a growing industrial land shortage, which is having major economic implications.

At the same time, some of the protected industrial lands across the region are no longer suitable for traditional industrial uses for reasons such as site-specific issues, the location adjacent to emerging residential areas, and accessibility to major roads required for truck traffic, as well as the opportunity costs of not optimizing transit-oriented development sites near SkyTrain stations.

The five sites identified by Mayor Sim are the former Molson Brewery at the south end of the Burrard Street Bridge, the former industrial sites owned by the municipal government at the southeast corner of the intersection of Main Street and Terminal Avenue next to SkyTrain’s Main Street-Science World Station, the Marine Gateway area next to SkyTrain’s Marine Drive Station, and the Mount Pleasant Industrial Area.

Concord Pacific owns the 7.6-acre former Molson Brewery site. Prior to the pandemic, the developer unveiled its “Quantum Park” concept of redeveloping the under-utilized property into towers up to 25 storeys, with 1.8 million sq. ft. of building floor area providing 300,000 sq. ft. of creative industrial, office, and retail/restaurant space and 3,000 homes.

The brewery was built at a time when False Creek saw heavy industrial uses. As well, the site’s freight needs were previously served by Canadian Pacific’s Arbutus railway corridor, which has since been dismantled, sold to the City, and converted into its current uses as an active transportation greenway.

Moreover, the adjacent built form of the Senakw’s high-density grove of towers up to 58 storeys likely sets some new precedent for what is possible for Concord’s brewery site.

Previous 2019 artistic rendering of Quantum Park, the redevelopment of the old Molson Coors brewery in Vancouver, conceived before the Senakw project. (Concord Pacific)

Previous 2019 artistic rendering of Quantum Park, the redevelopment of the old Molson Coors brewery in Vancouver, conceived before the Senakw project. (Concord Pacific)

Previous 2019 artistic rendering of Quantum Park, the redevelopment of the old Molson Coors brewery in Vancouver. (Concord Pacific)

PCI Developments has also been looking to build a second phase of Marine Gateway on a five-acre site, replacing car dealerships immediately south of the 2015-completed first phase.

Marine Gateway’s second phase would feature more high-rise towers — providing significant secured rental housing and affordable home ownership units on top of substantial creative/light industrial uses and some additional retail/restaurant space. The City of Vancouver also has a major works yard immediately east of this site.

Previous 2021 artistic rendering of Marine Gateway Phase 2 at 8530 Cambie St., Vancouver. (Perkins&Will/PCI Developments)

Previous 2021 artistic rendering of Marine Gateway Phase 2 at 8530 Cambie St., Vancouver. (Perkins&Will/PCI Developments)

The Mount Pleasant Industrial Area is the largest of the five sites, spanning the general area framed by Cambie Street to the west, 2nd Avenue to the north, Main Street to the east, and Broadway to the south.

Within the City’s Broadway Plan area, Sim states this is a centrally-located employment district with sites within the provincial government’s legislated Transit-Oriented Areas, specifically around SkyTrain’s Broadway-City Hall and Olympic Village stations and the future Mount Pleasant Station. He suggests there is a need for “modernized policy guidance” to “support innovative tech clusters, light industry, and creative economy uses while carefully considering residential uses.”

Currently, existing policies allow for a broader range of uses only along the perimeter of the Mount Pleasant Industrial Area. This has enabled high-density, mixed-use residential and office developments along the west side of Main Street, including projects such as the Main Alley tech campus and the City Centre Motel redevelopment. Sim’s motion suggests he wants to go even further than the current allowances.

Mount Pleasant Industrial Area. (City of Vancouver/Google Maps)

October 2022 artistic rendering of Prototype/M5 at 2015 Main St., Vancouver. (Henriquez Partners Architects/Westbank)

Artistic rendering of the City Centre Motel redevelopment at 2111 Main St., Vancouver. (Musson Cattell Mackey Partnership/Nicola Wealth Real Estate)

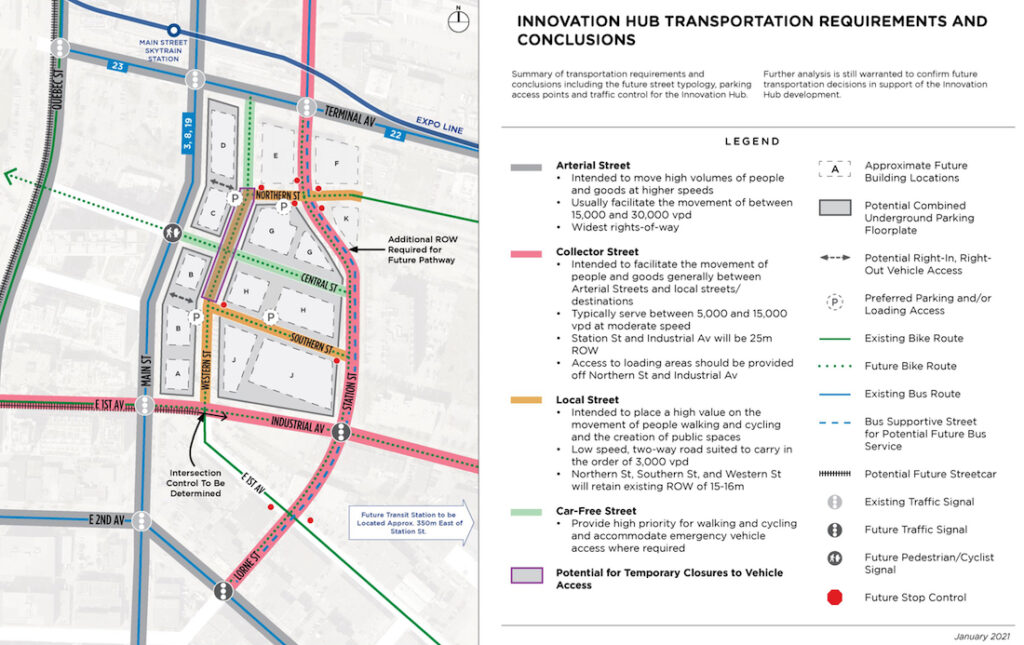

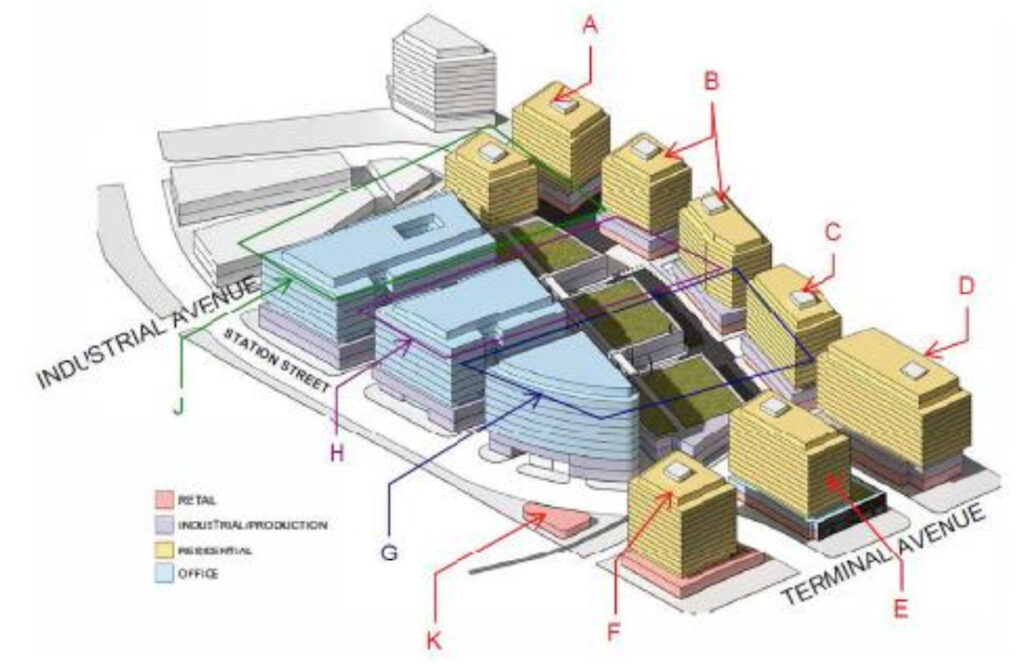

The fourth site at the southeast corner of Main Street and Terminal Avenue has been planned as an “Innovative Hub” under the City’s False Creek Flats Plan. A mix of innovation economy uses are envisioned, including laboratories, research and development, creative/light industrial, tech offices, arts and cultural facilities, local food economy spaces, some residential uses, and the active ground-level uses of retail and restaurants.

Recently, the City conducted a procurement process seeking a contractor to conduct a detailed technical feasibility study identifying redevelopment options for this 11.5-acre City-owned property next to Main Street-Science World Station.

The fifth exceptional site identified by Sim is the 11-acre Railtown district spanning about six city blocks, which he states is “a unique industrial and creative district requiring tailored policy guidance to support job space retention and cultural economy integration.”

Previous highly preliminary concept for the Innovation Hub site of the False Creek Flats Plan. (City of Vancouver)

Previous highly preliminary concept for the Innovation Hub site of the False Creek Flats Plan. (City of Vancouver)

Railtown district in Vancouver. (Google Maps)

Last week, City Council also approved a separate member motion by City Councillor Rebecca Bligh that specifically focuses on Railtown. That approved motion calls on City staff to similarly address the current industrial land use limitations, and explore enabling a wider range of uses for creative/light industry, office, retail, restaurants, services, and residential.

It also followed pleas from the executives of Aritzia and Herschel, whose global headquarters offices are located in Railtown. Both companies would like to remain and significantly expand in the area, but the area faces growing public safety and crime issues due to both its adjacency to the Downtown Eastside’s core area and the physical limitations of strict industrial uses.

Sim’s motion also directs City staff to prepare formal requests to the regional district in Fall 2025 to remove the protected industrial land reserve designation from any of these sites.

Additionally, City staff will explore options for future land use that maintain or intensify employment uses, while also “appropriately accommodating the potential for housing and public amenities such as green space, childcare, community and recreation facilities, and arts and culture spaces.” The relationship of the exceptional sites to public transit hubs and opportunities for “integrated job space intensification” will also be assessed.

Kenneth Chan| Jul 17 2025